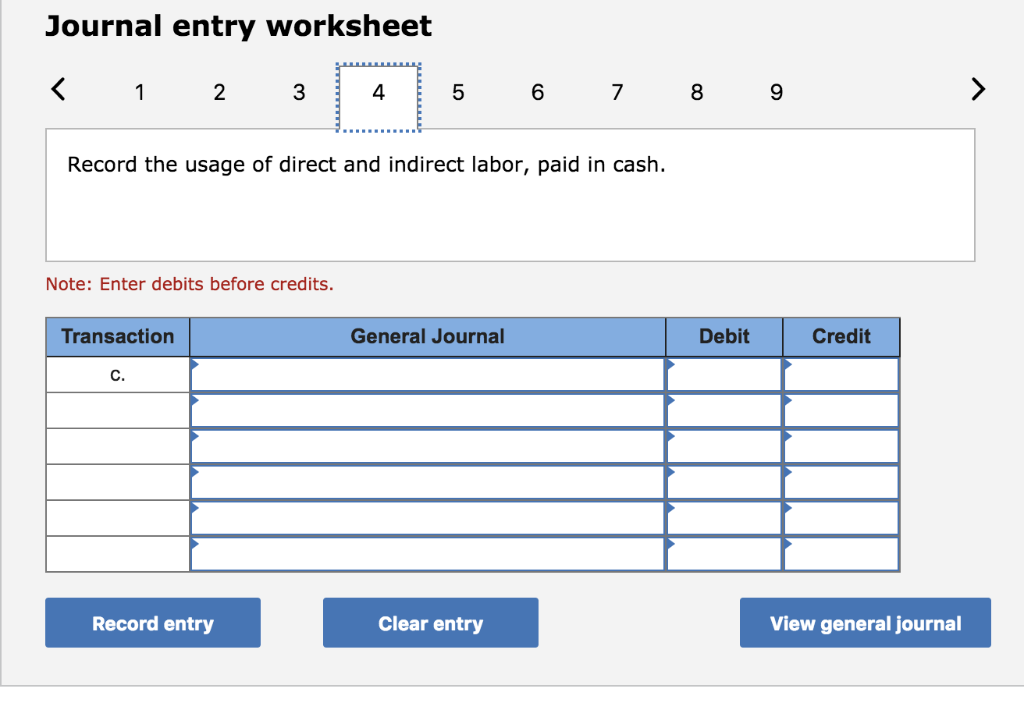

The transactions may occur between the parent and one of its subsidiaries, or between two subsidiaries. Intercompany accounting is the recording of financial transactions between two different entities that are related by the same parent company. Many businesses have divisions, subsidiaries, franchises, or other units that act independently but are owned by a larger, parent company. Accounts refer to a type of financial activity, such as an asset, liability, equity, or revenue. Journal entries record a transaction for a particular account, which refers to a specific portion of the business’s overall financial records. Journal entries apply to all financial transactions of a business or organization, including but not limited to cash payments, deposits, interest, taxes, payroll, purchases, loans, and more. Because they record all financial transactions, journal entries are the first step-and building blocks-of the business’s financial records. What Is a Journal Entry?Ī journal entry is created when a business records transactions in its accounting system. To better understand the specifics, it’s best to understand journal entries in general.

Intercompany journal entries are entries made in the business’s accounting ledger that pertain specifically to intercompany transactions.

0 kommentar(er)

0 kommentar(er)